cryptocurrency tax calculator ireland

Select your tax filing status. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms.

Today Marks The 2nd Anniversary Of Chinas Bitcoin Ban What Has Changed Bitcoin Cryptocurrency Capital Gains Tax

In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT.

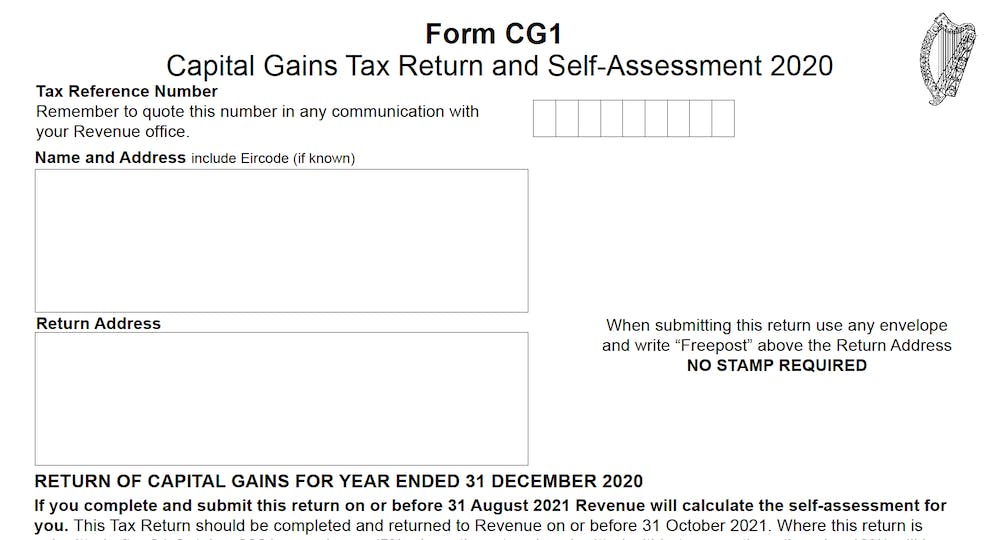

. Check the website for supported countries. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. If you are an Irish citizen you will need to file your capital gains from crypto trading on a Capital Gains Tax form for both the Initial and Later periods.

Therefore no special tax rules for cryptocurrency transactions are required. An underlying tax event on a transaction involving the use of a cryptocurrency there is a requirement in the tax code for a record to be kept of that transaction which will include any record in relation to the cryptocurrency. Gains and losses are calculated in your home fiat currency like the US Dollar to help you file.

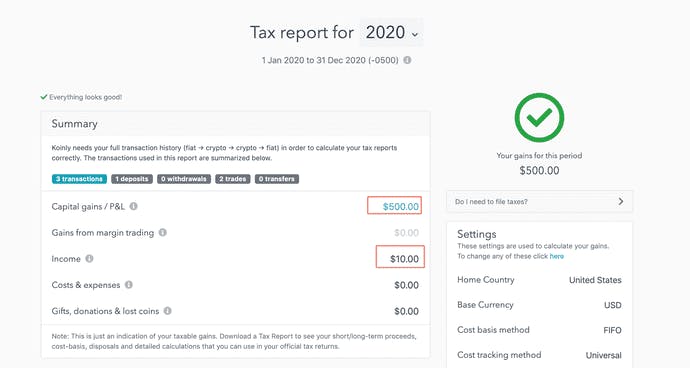

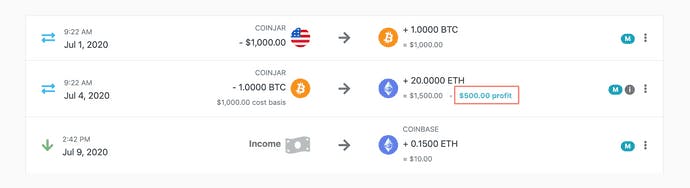

Koinly helps you calculate your capital gains for both periods in accordance with Revenue Commissionerss guidelines ie. Crypto tax calculators work by aggregating your data and then automatically linking your cost bases to your sales using accounting methods like FIFO or LIFO. June 4 2018.

This is very helpful to everyone who has bought sold and held Cryptocurrency in the last 12 months in particular. Using FIFO and the 4 weeks rule. Selling a cryptocurrency or digital asset for fiat currency is a taxable event.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. Whether you used an automated crypto trading app or made the trades yourself a crypto tax calculator will make it much easier to calculate how much you owe.

They calculate your gains or losses and automatically populate tax reports with your data. 16 December 2021 Please rate how useful this page was to you Print this page. In Ireland income tax on crypto activities typically involves getting Paid in Crypto accepting crypto for payment of goods and services airdrops signup referral bonuses interest from lending.

See Taxation of cryptocurrency transactions for guidance on the tax treatment of various transactions involving cryptocurrencies. Cardano Abu Stake Pool. Enter your states tax rate.

Fortunately the first 1270 of your cumulative annual gains after deducting expenses and losses from other cryptocurrency investments further details below are exempt from tax. Coinpanda generates ready-to-file forms based on your. For most people this is the same as adjusted gross income AGI.

You might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. How to use a crypto tax calculator to find your crypto tax liability. How to use a Bitcoin ATM in Seconds.

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier. Koinly is an app that makes it easy to import your data and download capital gains tax forms like the 8949 Schedule D and export to Turbotax. Irelands Revenue states that profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal income tax rules.

The web interface is pretty simple to use and supports the US UK Canada Australia and many other countries. Your total earnings before any taxes have been deducted. The deadline for filing CGT is at the end of this month.

Filing your taxes is already complicated but it can be more confusing if you have bought or sold cryptocurrency. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

Also known as Gross Income. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Online Crypto Tax Calculator with support for over 400 integrations.

February 12 2022 by haruinvest. These relate to gains and profits on trading andor investing in the currency type. Cryptocurrency Tax Calculator.

Youll then get a breakdown of your total tax liability and take-home pay. There are no special tax rules for cryptocurrencies. In Ireland crypto investments are treated just like investments in stocks or shares.

Cryptocurrency Tax Ireland. If you are dealing in cryptocurrencies you need to make a declaration to Revenue even if you have incurred losses. CoinTrackinginfo - the most popular crypto tax calculator.

Irish Tax Guide to Cryptocurrency Trading Investing With the surge in the amount of people now dabbling in the cryptocurrency market herewith a guide to the Irish tax implications. Best Platforms for Day trading Cryptocurrency in 2021. While cryptocurrencies are not legal tender in Ireland an investment in them is subject to taxation.

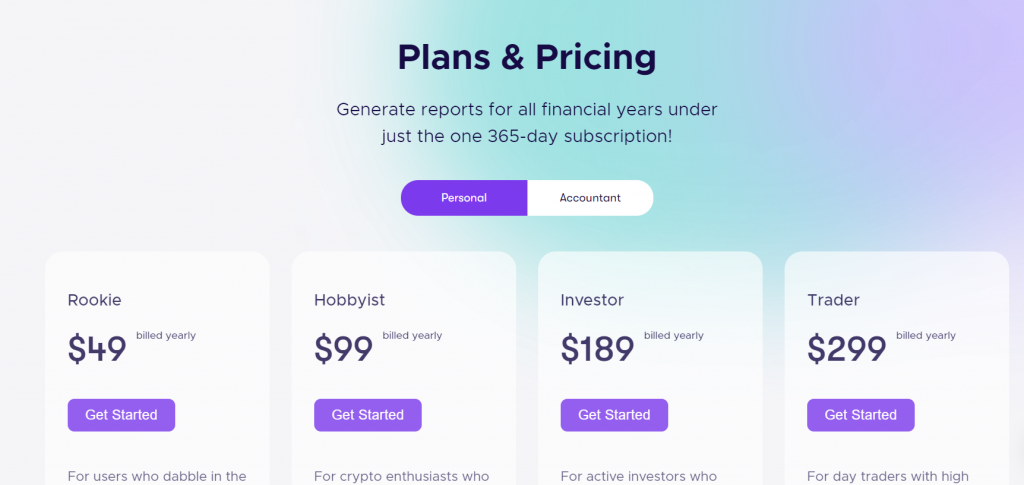

But any profit that you make above this figure will be taxed at 33 and you will need to file a tax return each year. Best Places to buy Bitcoin Online. 49 for all financial years.

Buying goods and services with crypto. After some delay the Irish taxation service the Revenue Commissioners have finally issued guidance on how they see Cryptocurrency being taxed in Ireland. Where there is an underlying tax event on a transaction involving the use of a cryptocurrency there is a requirement in the tax code for a record to be kept of that transaction which will include any record in relation to the cryptocurrency.

Crypto Tax Calculator. Therefore11Income no special tax tax rules for cryptocurrency transactions are required. Capital gains tax CGT form.

Select the tax year you would like to calculate your estimated taxes. The original software debuted in 2014. Capital gains tax report.

In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. You are liable for capital gains tax on the amount if any that your original holding appreciated in value since you bought it. Since then its developers have been creating native apps for mobile devices and other upgrades.

They compute the profits losses and income from your investing activity based off this data. Back to homepage Back to top. Capital losses may entitle you to a reduction in your tax bill.

This means that profits from crypto transactions are subject to capital gains tax at. Enter your taxable income excluding any profit from Bitcoin sales. What is a Crypto Tax Calculator.

Irish citizens have to report their capital gains from cryptocurrencies. Revenues view is that an investment in cryptocurrency is the same as a share investment and accordingly should be subject to Capital Gains Tax at 33.

Ireland Cryptocurrency Tax Guide 2021 Koinly

Google Bans Cryptocurrency Mining Apps From Play Store Google Play Store Cryptocurrency App

Capital Gains Tax Calculator Ey Singapore

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

Ireland Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Tax Tax On Gains From Selling Cryptocurrency In India

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe